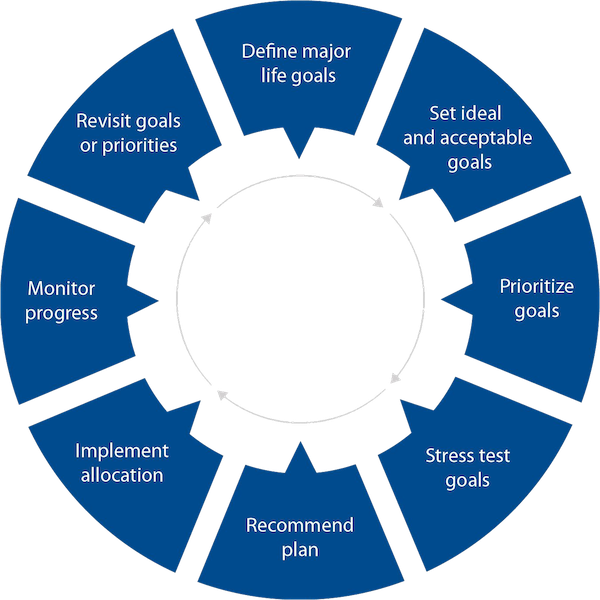

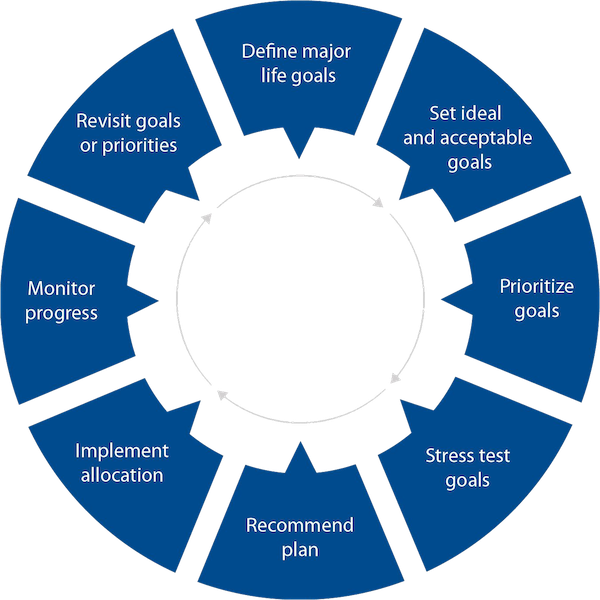

The Envision Process

Our Envision process helps clients easily set and achieve their important life goals.

- Define major life goals.

- Set ideal and acceptable goals.

- Prioritize goals.

- Stress Test Goals.

- Recommend plan.

- Implement allocation.

- Monitor progress.

- Revisit goals or priorities.

Don't settle for cookie-cutter investment planning that's impersonal and vague.

The Envision process is different. It goes beyond choosing an investment strategy and hoping for the best. It's a life planning tool that helps you and Be Free Wealth Management explore your goals and plan investments around benchmarks that matter to you.

With Envision, you can track your progress and adjust your approach whenever necessary.

1. Define Major Life Goals

You and your financial advisor will sit down together to begin exploring your goals and dreams and discuss any concerns you might have around achieving them.

2. Ideal And Acceptable Goals

You'll examine your ability to achieve your goals in multiple scenarios, starting with the ideal and the acceptable. The ideal scenario represents your goals and dreams in a “perfect world.” The acceptable scenario represents the compromises you could make to your ideal goals and still feel comfortable with your life.

3. Prioritize Goals

To explore as many of your ideal goals as possible, we encourage the use of our Envision Priority Cards. This interactive activity ensures that you and your financial advisor are on the same page, working together to achieve the goals you value most.

4. "Stress Test" Goals

To determine the level of confidence you can achieve with your ideal and acceptable goals, Envision stress-tests each scenario 1,000 times. During each of these 1,000 iterations, your goals are subjected to simulated random market returns (up years, down years, flat years, etc.) to help you determine how likely you are to achieve your goals.

5. Recommendation

“In balance” targeted confidence. Once your financial advisor has an understanding of your ideal or acceptable goals, he or she will create a recommended scenario incorporating the goals you value most while potentially deemphasizing some of your lower priority goals.

6. Implement Allocation

Based on your goals, dreams, concerns, risk tolerance, and financial circumstances, your financial advisor can propose an investment mix to help you achieve those goals.

7. Monitor Progress

Your Envision plan will create a benchmark unique to your goals and circumstances as a way to track progress along the way. This information will update each night and is available on your statements and online.

8. New Goals And priorities

Change can present challenges, whether it happens in your own life or in the world around you. If your goals or financial circumstances change, or the markets fluctuate, it's easy to update your Envision plan to account for the changes and measure the impact it has on your ability to stay on track.

The projections or other information generated by Envision tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. These assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk, return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2021 Wealthcare Capital Management LLC. AlI Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.